BlueStone is set to make history today, becoming the first new-age Indian jewellery brand to debut on the stock exchanges. So, how does the omnichannel giant’s IPO stack up as it sets sail for D-Street?

Decoding BlueStone IPO: The omnichannel jewellery brand’s public issue comprises a fresh issue of shares worth INR 820 Cr and an OFS component of 1.4 Cr shares. It has set a price band of INR 492 to INR 517 per share for its IPO, pegging the startup at INR 7,800 Cr at the upper end of the spectrum. The company’s public issue also saw oversubscription of 2.7X, witnessing ample demand from institutional buyers and retail investors, but HNIs seemed unenthused.

BlueStone’s Fading Glow: The most glaring challenge for BlueStone is profitability, which appears elusive in the short term. Here is how it fared in FY25:

- Losses soared 56% YoY to INR 221.8 Cr

- Expenses surged 41.7% YoY to INR 2,049.9 Cr

- Operating revenues grew 40% YoY to INR 1,770 Cr

Largely to blame for the ballooning losses is its aggressive offline expansion, rising expenses, slowing demand, a cautious market and a cluttered jewellery space dominated by giants. Sitting on inventory worth INR 1,652 Cr could also become a significant financial drag if not managed efficiently.

Striking Gold: What works for BlueStone is its steady revenue stream from offline stores, industry-leading gross margin of 38%, a tech-driven approach and strong brand recall.

Amid all this, VC firm Saama Capital is sitting on gains worth 10X while Accel India will be looking to rake in 8X returns from its initial investment in the company. As BlueStone enters the public spotlight today, here’s who stands to make a fortune.

From The Editor’s DeskWebEngage’s Next Frontier: From closing FY16 with a humble $3,000 in revenue to a top line of $22.8 Mn in FY25, the SaaS startup has come a long way. While marketing automation tools fueled its early start, WebEngage is now turning to AI to power its next stage of growth.

Captain Fresh Files DRHP: The B2B seafood startup has filed its DRHP with SEBI via the confidential route for a $400 Mn IPO, equally split between fresh issue and OFS. Meanwhile, the startup clocked a profit of INR 40 Cr on a revenue of INR 3,200 Cr in FY25.

WeFounder Circle CEO Passes Away: The angel network’s cofounder Neeraj Tyagi passed away on August 16 at the age of 50. The cause of his death is not known. He was a notable face in India’s investment space, backing startups like Zypp, Oben and Garuda Aerospace.

Boundless Ventures’ Maiden AI Fund: Former Kae Capital partner Natasha Malpani has launched the early stage fund, with a target corpus of INR 200 Cr. It will back 20-30 Indian AI-native startups, and will dish out cheque sizes ranging between $200K to 400K.

Artha Closes INR 432 Cr Fund: The Ashok Kumar Damani’s family office has marked the final close of its follow-on Artha Select Fund. The fund will back the top 15% of Artha’s existing portfolio and will invest INR 20 Cr each in 12–14 companies.

New CBO At ShareChat: The homegrown social media platform has appointed ex-Google executive Neha Markanda as the chief business officer for both its ShareChat and Moj platforms. This follows Gaurav Jain stepping down from the role in June this year.

Foxconn’s iPhone 17 Tryst: After Chennai, the manufacturing giant has now commenced the production of Apple’s iPhone 17 at its Bengaluru unit, albeit on a small scale. This is in line with Foxconn’s plans to double its iPhone production in India to 25-30 Mn units by 2025-end.

Astrotalk Gets A New CFO: The online astrology platform has roped in former GlobalBees executive Deepak Khetan as its new chief financial officer. The appointment comes as Astrotalk is looking to strengthen its top brass ahead of its IPO in 2027.

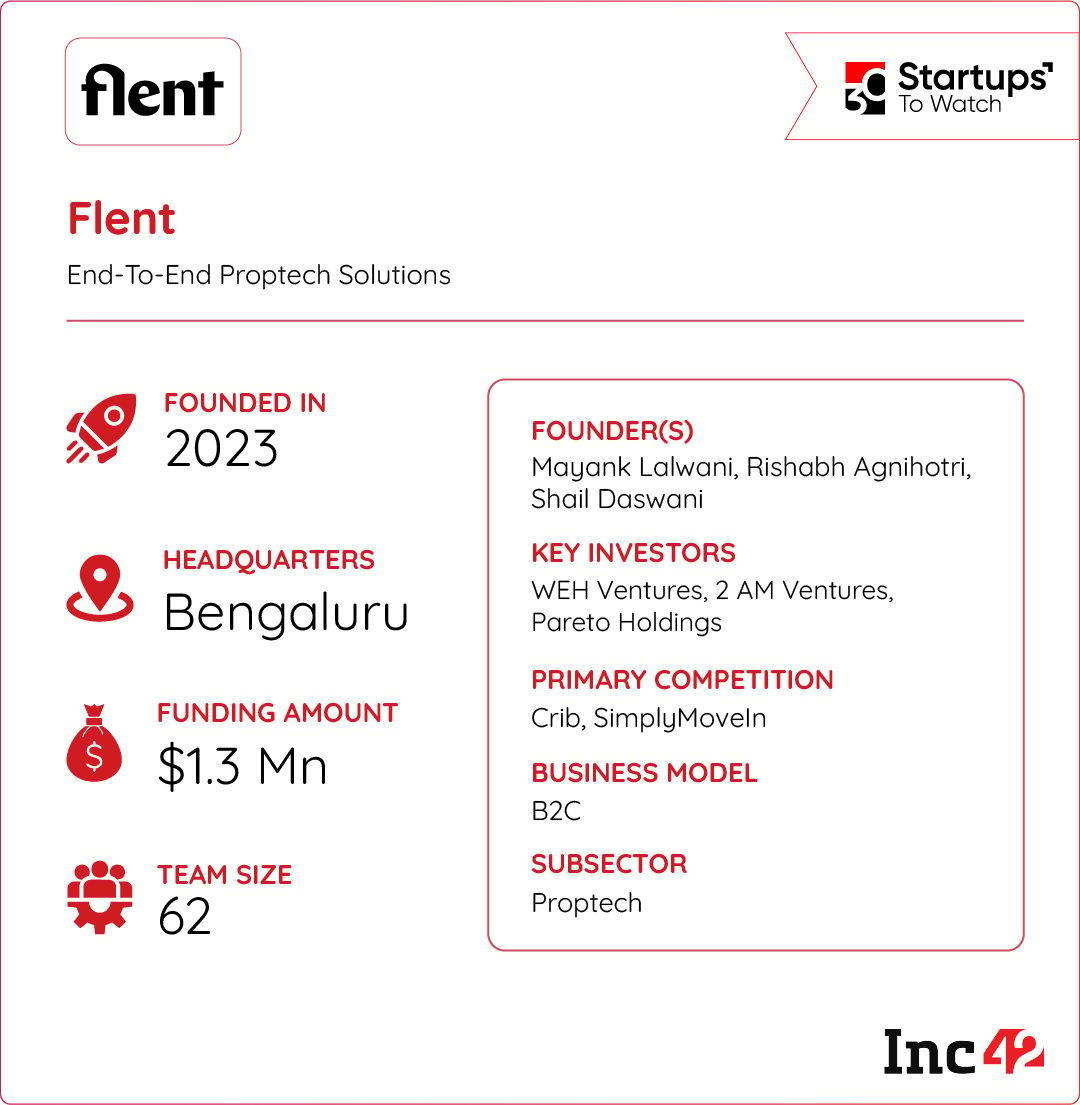

Inc42 Startup Spotlight Can Flent Fix India’s Broken Home Rental Market?In India’s fast-paced metros, renting is a struggle. High brokerage fees and steep deposits make the process expensive and exhausting for young working professionals. Founded in 2023, Flent aims to solve this problem by offering a streamlined rental experience.

The Full-Stack Advantage: The startup offers fully furnished, designer rental homes tailored for young professionals. Unlike traditional brokers, Flent takes full ownership of the rental process, from sourcing properties to managing them.

A Win-Win Proposition: Flent’s model is designed to create a win-win situation for both tenants and landlords. For renters, it provides ready-to-move-in spaces with flexible lease terms. For homeowners, Flent acts as a complete property manager, ensuring higher occupancy rates and a steady income stream without the usual operational headaches.

Can Flent Carve A Niche? Flent operates in the broader Indian proptech market, which is projected to cross the $3.7 Bn mark by 2030. But, it faces stiff competition from players like Crib and SimplyMoveIn. Armed with a solid business model and a clear market opportunity, can Flent’s full-stack approach help it stand out in the competitive proptech market?

The post BlueStone Lists Today, WebEngage’s Next Frontier & More appeared first on Inc42 Media.

You may also like

Konstas signs 4-year contract extension with Sydney Thunder

Kapil Show: Special screening of 'The Great Indian Kapil Show' held for the blind, comedian said- I am happy..

PM Modi Hails Astronaut Shubhanshu Shukla's Return From ISS Mission, Calls It 'Our First Step' In Human Space Exploration - VIDEO

RFS Koparkhairane Athletes Shine at CBSE Cluster IX Athletics Meet 2025–26

Thama: First look of Rashmika, Nawaz and Paresh Rawal revealed from 'Thama'..